예능다시보기

최근 가장 시청이 많은 한국 예능프로그램: 감동과 웃음의 향연

최근 가장 시청이 많은 예능프로그램: 안녕하세요, 예능 프로그램을 사랑하는 여러분! 최근 한국 예능계는 다양한 프로그램들로 가득차 있습니다. 그 중에서 특히 …

엔터테인먼트

2023년 넷플릭스 최고 시청률 영화, 드라마

예능다시보기

2023년 해외 여행 추천 top 6

최근 가장 시청이 많은 한국 예능프로그램: 감동과 웃음의 향연

마스터 요다

최근 가장 시청이 많은 예능프로그램: 안녕하세요, 예능 프로그램을 사랑하는 여러분! 최근 한국 예능계는 다양한 프로그램들로 …

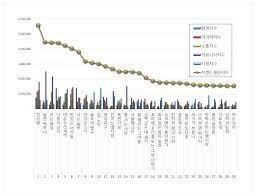

넷플릭스 영화와 드라마의 인기 순위 및 OTT 사이트

마스터 요다

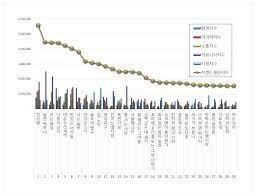

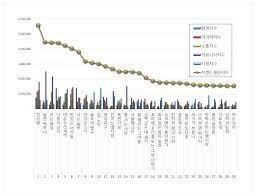

넷플릭스 영화와 드라마의 인기 순위 넷플릭스는 현재 전 세계적으로 가장 인기 있는 OTT(Over-The-Top) 사이트 중 …

최근 가장 시청이 많은 한국 예능프로그램: 감동과 웃음의 향연

최근 가장 시청이 많은 예능프로그램: 안녕하세요, 예능 프로그램을 사랑하는 여러분! 최근 한국 예능계는 다양한 프로그램들로 …

넷플릭스 영화와 드라마의 인기 순위 및 OTT 사이트

넷플릭스 영화와 드라마의 인기 순위 넷플릭스는 현재 전 세계적으로 가장 인기 있는 OTT(Over-The-Top) 사이트 중 …